T. Rowe Price Launches Campaign To Help Parents Of Young Children Cope With The "Sticker Shock" Of College Costs

News

CollegeSavingsChillout.com takes a practical approach to start saving for college by sharing easy-to-digest content aimed at relieving the stress many parents feel when thinking about how much college costs. Presenting six simple steps,

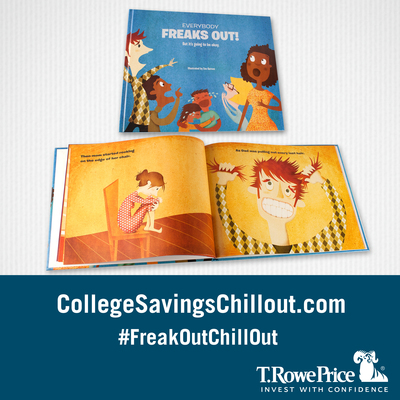

The campaign also features a book titled Everybody Freaks Out, which is aimed at parents but written and illustrated in the style of a children's book. Everybody Freaks Out is a lighthearted book that tells the story of how two fictitious parents are able to move past their college savings panic. The book is available as a free, digital download on CollegeSavingsChillout.com or on Amazon.com for

This summer, the firm will soothe parents further by bringing Calming Tea Carts to

According to the findings of

Six Steps for Starting From CollegeSavingsChillout.com

- Have a plan and do what you can. Parents do not have to save for the entire cost of college. Instead, perhaps they plan to save for two years of school or just one. Every bit of savings will help, even if it's only enough to cover a portion of children's expenses. Instead of making the total number an enemy, make a personal goal the hero.

- Just get started. Parents should start by saving an amount that's manageable. Doing it now may help parents save money and frustration in the future by needing to borrow less.

- Don't try to do this alone. Get others involved. When friends and family ask for gift ideas, parents should suggest that people give to their kids' college savings plan. As kids get older, they too can contribute to the plan by saving money earned from babysitting or other work.

- Make a 529 plan work for you. These college savings plans offer the flexibility to pay for qualified private or public colleges, universities, and graduate schools, as well as vocational and trade schools anywhere in the country. Parents can also use the money in the account for any of their kids or themselves by changing the beneficiary.

- Take care of life's necessities. Give a little to each. Parents should start by setting their priorities and then funding them accordingly. If the goal is a four-year private education, go for a slightly less expensive car or home and direct those savings into a 529 for college and an IRA for retirement. Your savings plan can always be adjusted along the way.

- Let

T. Rowe Price help. Parents can call 1-855-529-CHILL to learn more about saving for college or visit www.collegesavingschillout.com.

Quote

"Our research shows that over a quarter of parents are losing sleep worrying about college costs. And we hear from parents that saving for college is an emotional decision. They feel overwhelmed by not only the cost, but also by making the best decision for their child's future. The goal of our campaign is to help people overcome these feelings and encourage them to just get started on saving for college. It's important that they put time on their side."

About

Founded in 1937,

Please note that a 529 plan's disclosure document includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. You should compare these plans with any 529 college savings plan offered by your home state or your beneficiary's home state. Before investing, consider any state tax or other benefits that are only available for investments in the home state's plan.

Photo - http://photos.prnewswire.com/prnh/20140512/86772

SOURCE

News Provided by Acquire Media